Cases Studies

RPA

RPA for Banking

RPA for Health

RPA for Call Center

RPA for Retail

RPA For Kuwait Civil ID

RPA for Pharmacovigilanc

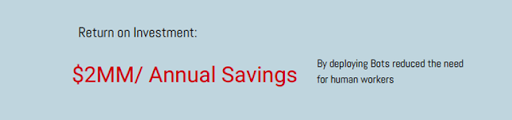

Factory Monitoring Demo

Live Video

- Delinquent Deposit Account Recoveries

- Credit Card Balance Transfers

- Credit Card Expired Authorization Reconciliation

Delinquent Deposit Account Recoveries

Every day, 10,000 deposit accounts (consumer bank accounts) were in delinquent status (Overdrawn for > 90 days). Based on the bank’s cardholder agreement, after 90 days in consistent overdraft status, the bank reserved the right to draw funds to cover the overdraft amount from another account held by the same card holder that was in positive balance.

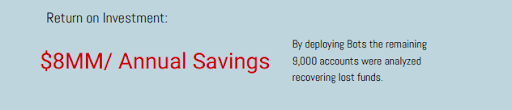

Performing the analysis manually across 10,000 accounts daily, looking for an alternate account held by the cardholder to draw funds from to cover the delinquent overdraft amount was an arduous task. The bank hired 10 staff members to perform this task and the team of 10 people could only cover 1,000 of the 10,000 delinquent accounts per day, leaving 9,000 accounts unanalyzed daily and thus missing the opportunity to recover hundreds of thousands of dollars daily.

Implementing automation allows the digital ‘bot’ workforce to analyze all accounts in a single day, thus saving the bank hundreds of thousands in recoveries daily and minimizing the run-cost of this operation.

Credit Card Balance Transfers

The bank received thousands of credit card balance transfers daily from its balance transfer forms situated on its website open to customers to request a balance transfer when desired. Each submission of a form resulted in an email that was sent to the back-office credit card operations team to manually perform the balance transfer within the bank’s credit card systems based on the customer request sent by email. This resulted in the need for 25+ back-office staff to manually enter this information daily.

Automating this process present balance transfers in near real-time and avoid the need for a team of 25+ human

workers to perform this task.

This both allowed for volume spikes to be handled and for a significant cost reduction in the run-cost of the operation.

Credit Card Expired Authorization Reconciliation

When credit card authorizations are approved many of them expire and require manual reconciliation to correctly balance the available credit on the customer’s account. Each expiration required analysis by a human to review the authorization, its source, its time of expiry and funds utilized by the related transaction. With tens of thousands of expired authorizations requiring this analysis, the task was arduous and required a team of 45+ back-office credit analysts to perform this work

Automating this process allowed for the avoidance of a need to staff a large number of people to manage the task, and to handle significant volume peaks of expiring credit card authorizations each Monday and Tuesday due to high customer spending each weekend.

This both saved the bank significant operational costs and allows the expired authorizations to be handled in a timely manner before unbalanced credit availability impacted a customer’s ability to use their card and thus causing increased customer satisfaction

The GCC as many countries and regions around the world are experiencing an Increase in lifestyle related diseases like

- Smoking related cardiovascular disease

- Childhood obesity

- Diabetes

With this in mind, an increase in healthcare spending annually is targeted to grow up to $104 billion by 2022.

As private insurance feels this pressure, a continued demand to see a more efficient healthcare system is paramount.

In addition, with this growth will come a continued increase in building public and private facilities.

An increasing demand for Medical Tourism. The UAE is leading the way for increased medical tourism sites, but Bahrain and other countries are growing facilities with external funding.

Lastly there is a regional emphasis on the patient experience, starting with the digitization of medical records. With the Public Authority for Civil Information (PACI) in Kuwait releasing a digital ID, other regions will follow, and healthcare initiatives will be digitized to enhance overall experience.

Areas that GoAutomate assists organizations and health departments with.

- Support in the digitization of medical records. Healthcare systems can vary, and complexities exist. Our orchestration systems help alleviate the pain of integration.

- In the absence of a regional Unique Patient Identifier GoAutomate can create a system that will allow for the storage and retrieval of all medical records anywhere in the region.

- In the event of multiple local Electronic Medical Record (EMR) providers, GoAutomate can provide an automated workflow that is able to check multiple known sources and provide a summary for the primary care physicians.

- Insurance Billing – Correlate billing codes with exams to ensure the correct information is sent to the insurance company for reimbursement. Verification of insurance at point of contact to ensure accuracy and higher rate of acceptance.

- Business Analytics – Realtime dashboard with asset utilization reporting, productivity tracking dynamic scheduling and business performance tracking.

- GoAutomate can support the creation of an electronic triage system to connect patients with the most qualified clinician. A rules-based rating system that looks at the patient history and current issue to determine the best clinician.

- GoAutomate can support the creation of standardized reporting that can be used by clinicians to document their patient engagement and store the electronic file.

- 08.Multi-lingual support for medical tourism clients from India, China and Russia. GoAutomate can provide support in the parsing of electronic records prior to the local engagement with the medical facility.

A digital transformation and workflow company in healthcare required an AI enabled optimized approach to managing health related information. The workflow’s built are designed to provide more e£cient data processing to the clinician. This company manages multiple millions of scans per year and required a solution to assist that could scale and provide a true increase in clinician efficiencies.

GoAutomate built machine learning modules that uses Natural Language, Optical Character Recognition and document and DICOM (Digital Imaging and Communications in Medicine) extraction that can provide summary and executive reports in near real time to the Clinician by reading HL7 (Health Level 7) data and compiling these reports during the processing of the documents.

A call center client provides large enterprises with efficient sales teams and does so using a proprietary application.

As an exponentially growing company, they faced several challenges that GoAutomate was called upon to assist with. Application platforms were performing poorly due to the load being placed on them. They needed additional growth via efficiencies to ensure staff scale up was minimized. Lastly, GoAutomate was requested to enhance the platform in such a way that it is designed to scale and grow as the organization continues to expand.

GoAutomate provided its team to evaluate the existing platforms and perform enhancements based on key areas of criticality.

Growth of the platform was verified using process and application discovery. Based on these finding’s application redesigns are being implemented with additional functions in automation to provide an overall more efficient application that can provide reporting and other key dashboards proactively rather than on request.

Implementing these abilities will improve overall design and functionality of the application. In addition, GoAutomate is designed to scale and perform thousands of tasks simultaneously and with integration into the existing platform, now the client application can appreciate the same level of throughput.

Implementation of these features will allow further growth and add additional customers to the client.

GoAutomate was asked to assist one of Canada’s largest petroleum distributors with locations across Canada.

The client had grown at a reasonable pace over the years and with growth and onboarding new platforms introduced complexities around managing invoices, procurement, accounts receivables and payables. The client was forced to continually grow the accounting team and issues were constantly occurring in he processes due to the complex nature of this department.

GoAutomate provided its team to evaluate the existing platforms and perform enhancements based on key areas of criticality.

GoAutomate team orchestrated data management across the various platforms. We designed activities around the EDI and procurement processes. We utilized OCR tools to read and capture invoice data and injected the data into the accounting platform. Finally, we used the data capture to work on order management systems and assist in payroll processes.

Implementing these abilities, we improved the overall design and functionality of the accounting department.

In addition, GoAutomate is designed to scale and perform thousands of tasks simultaneously as they continue to grow the application will continue to scale

High level example of process that was orchestrated

Kuwait Mobile ID is a secure mobile-based Digital ID derived from the Civil ID. It is capable of identity verification, COVID-19 vaccination certificate, authentication to online e-services, and applying trusted digital signatures to documents and transactions.

Digital CIVIC IDs provide reliable authentication and enable delivery of a range of services via digital applications. It has the potential to generate significant benefits in the economic and social space. Lowering costs, increasing flexibility for the public, greater regulation and transparency are a few items to gain interest.

Digital Identity and Identification are the two means of providing firstly a digital representation and secondly the ability to utilize that digital medium to perform Identification for services that are required.

A nation that has done this well (albeit a few hiccups) is Kuwait. The Public Authority for Civil Information has deployed a mobile platform that is now being used to provide anything from government paperwork, banking to telecommunication companies providing payment processing.

As countries around the world adopt digital id and Identification, this leaves questions for business:

- 1 How to connect ID into existing platforms

- 2 How to digitize existing processes to benefit from this technology.

- 3How to minimize the costs associated with this mandatory movement forward, that both the government will mandate, and existing clients will demand.

With GoAutomate you can develop the connection into the regional ID platform. Once itegrated additional integrations are not required. Reuse the connection for other platforms and services.

Integrate without rebuilding Utilizing integration for other platforms Design and develop once

Building connections and orchestration between platforms has never been easier. Transform your business to a modern age with minimal complexities and delays.

HOW RPA AND AI CAN HELP LOWER COSTS FOR PHARMA DRUG SAFETY.

WHAT IS PHARMACOVIGILANCE?

Pharmacovigilance [PhV] is “the science and activities relating to the detection, assessment, understanding and prevention of adverse effects or any other drug related problem” as defined by the WHO

Pharmaceutical companies perform PhV to help provide enhanced patient safety. To do this the organization will collect and review data from distribution channels ensuring products meet certain criteria and determine if any of the following occurs:

- Additional unknown adverse effects occur

- Determine if frequency and severity of known issues changes.

- Ensure information provided remains accurate.

- And more.

OBTAIN DATA IN AN EASY TO MANAGE DATA SET

Meeting regulatory obligations, managing risk and obtaining data in an open reporting tool can be challenging. Manage the various formats like ICH E2B, CIOMS, EU ICSR, introduces additional complexities.

Using natural language, optical character recognition with large data set amalgamation ensures your data being received from spontaneous reports and other data sources is stored digitally and manageable in a consistent format.

Using a digital format stored in your database makes studying the data more efficient.

No longer worry about changing your internal systems, using RPA the format can be entered into existing systems.

DETECT SIGNALS OF NEW ADRS EFFICIENTLY

Online shoppers are becoming more aware of the importance of online security and many of them require secure connections before submitting personal and payment information online. Online shoppers need to be assured that your website can be trusted and Secure Socket Layer (SSL) Certificates provide a visual indicator that your website is both secure and legitimate.

All our SSL Certificate Provide:

- Fast domain ownership validation process.

- 99% browser recognition.

- Live 24/7 support.

- Includes warranty.

- High security with 128-bit and high grade 256-bit encryption.

Choose Your SSL Certificate:

We support 4 brands of SSL certificate providers, and when choosing an SSL Certificate, consider the brand recognition, turn-around time and investment cost that is right for your business. Start building consumer confidence and online profit by selecting a brand below

- VeriSign

VeriSign, Inc. is the trusted provider of Internet infrastructure services for the networked world. Billions of times each day, VeriSign’s SSL certificates, identity and authentication, allow companies and consumers all over the world to engage in trusted communications and commerce.

Choose the most trusted mark on the Internet and enable the strongest SSL encryption available to every site visitor — recognized by 79% of U.S. online shoppers, many businesses have seen a lift in sales by 10% or higher—allowing you to calculate the return on your investment. - GeoTrust

GeoTrust® is the world’s second largest digital certificate provider. More than 100,000 customers in over 150 countries trust GeoTrust to secure online transactions and conduct business over the Internet. Our range of digital certificate and trust products enable organizations of all sizes to maximize the security of their digital transactions cost-effectively.

GeoTrust’s world-class SSL Certificates offer brand recognition and fast delivery. Maximize your investment by quickly securing your website in the most cost-effective and efficient way. - Starfield

Starfield is an innovator in the field of Internet foundation services, providing advanced software and Internet solutions critical to the building of a strong online presence.

A Starfield SSL certificate ensures that all sensitive transactions are kept securely encrypted and safe from prying eyes, and rigorous authentication guarantees that Starfield certificates are issued only to entities whose existence and domain registrant information can be verified. Starfield SSL certificates offer industry-leading security and versatility.

Common Features

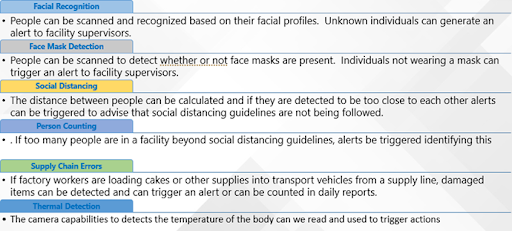

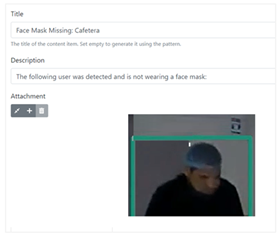

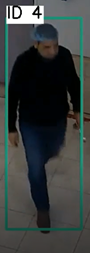

- Detects the employee Face and either recognize it or give it an ID

- Detects Body and face

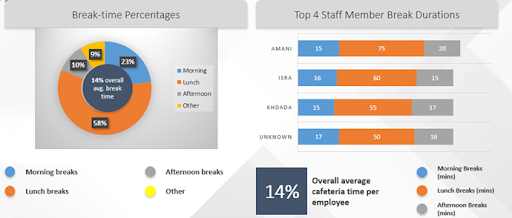

- Time is calculated for all workers

- Alerts are sent in case of stranger

- Alerts can include case details with photo

Features

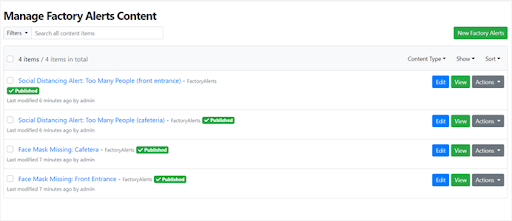

- All events can trigger a workflow.

- Alerts are triggered and send to supervisors

- Reports are generated

Case

- The case is queued

- Sent to related supervisor with photo and description

Reports